TABLE OF CONTENTS

INFORMATION CONCERNING THE ANNUAL MEETING

Who can attend the annual meeting?

Annual Meeting?

All shareholders of Astronics Corporation who owned shares of record on April 5, 20214, 2023 may attend the meeting.Annual Meeting. If you want to vote in person and you hold Astronics Corporation common stockCommon Stock in street name (i.e., your shares are held in the name of a brokerage firm, bank or other nominee), you must obtain a proxy card issued in your name from your

broker and bring that proxy card to the meeting,Annual Meeting, together with a copy of

a brokerage statement reflecting your stock ownership as of the record date, and valid identification. If you hold stock in street name and want to attend the meetingAnnual Meeting but not vote in person at the meeting,Annual Meeting, you must bring a copy of a brokerage statement reflectinglegal proxy issued to you by your stock ownership as of the record date,broker or nominee and valid identification.

TABLE OF CONTENTS

PROXY SUMMARY

ENVIRONMENTAL, SOCIAL AND GOVERNANCE HIGHLIGHTS

ENVIRONMENT

Environmental Approach

Astronics is committed to minimizing the impact of its activities on the environment. The Company maintains a variety of formal policies and procedures related to protection of the environment, energy conservation and waste management, as well as general business practices that are part of its culture. These policies and procedures are specific to each subsidiary. In most instances, these policies and practices are embedded in Astronics’ Employee Handbook. Employees must certify – in many cases annually -- that they have read and will comply with the Employee Handbook. In fact, Astronics’ PECO facility is a Zero Liquid Discharge facility.

In addition, when considering an acquisition or partnership, the Company embeds questions specific to the environmentenvironmental matters within its due diligence approach. These include claims, policies, certifications and procedures relative to environmental management. Astronics Corporation asks these in an effort to both promote positive environmental policies and practices as well as to minimize any risk when assessing the acquisition candidate.

While Astronics does not currently track environmental metrics on a company-wide basis, the Company recognizes the value and importance of reducing its impact on the global environment.

Certifications and Training

One of the Company’s largest operations, Astronics Connectivity Systems & Certification Corp., is certified to and Astronics Advanced Electronic Systems Corp. have processes that comply with the requirements of ISO-14001, the international standard for effective environmental management, while its largest operation, Astronics Advanced Electronic Systems Corp., has processes that comply with the requirements for ISO-14001 certification.management.

Regardless of the formal certification, mostMost of the Company’s operations maintain formal programs that establish goals and measure progress towards those goals regarding reductions and disposal of hazardous substances, recycling and minimization of power consumption, among other efforts. In those operations that are not ISO-14001 certified,compliant, Astronics meets or exceeds all applicable environmental laws and

regulations by maintaining many initiatives and practices that reduce its impact on the

environment. Some examples of such initiatives and practices include policies to reduce paper, policies to reduce single occupancy commuting, replacement of older, less-efficient lighting with energy efficient motion-based LED lighting, active waste recycling, water consumption reduction programs, and providing electric car recharging stations and bicycle storage at its largest operation.

Each subsidiary is expected to conduct both government/regulatory mandated training as well as professional development training, depending upon that subsidiary’s areas of expertise. Specific certifications may be found at each subsidiary website: https://www.astronics.com/subsidiaries.

While Astronics Corporation does not have a separate vendor code of conduct, as part of its contracts, the Company Code of Conduct requires that its vendors adhere to the spirit of its Code of Ethics (see Social/Human Capital Management). In addition, language to this effect is often included in the Terms and

and Conditions portion of the Company’s contracts with suppliers and customers. When required as part of an agreement, Astronics Corporation has signed a customer’s Code of Conduct.

TABLE OF CONTENTS

Astronics strives to maintain the integrity of its supply chain to the best of its ability and, to date, the Company has not had a significant supply chain disruption.ability. Astronics Corporation files Form SD Conflict Minerals Disclosure to be compliant with SEC regulations and, in many instances, the Company also is

also is required to comply with government standards in evaluating and choosing suppliers. Each subsidiary works with its suppliers to determine if legal and regulatory requirements are met.

Astronics will complycomplies with all applicable conflict minerals regulations, including the US Securities and Exchange Commission’s Conflict Minerals Rule and the European Union’s Conflict Minerals Regulation.

Astronics’ Conflict Minerals Policy is to only use tin, tungsten, tantalum, or gold whose source can be traced to scrap/recycled materials or smelters and refiners that are conformant with the Responsible Minerals Initiative‘sInitiative’s (RMI) Responsible Minerals Assurance Process (RMAP). Astronics encourages the use of responsibly mined minerals from the Democratic Republic of the Congo and adjoining countries.

To ensure compliance with this policy, Astronics has put in place procedures that conform with the Five-Step Framework

for Risk-Based Due Diligence as described in OECD Due

Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas.

Astronics’ standard purchase order terms and conditions require our suppliers to adapt a conflict minerals policy similar to Astronics and to provide Astronics each year with an updated Conflict Minerals Reporting Template (CMRT), the industry-standard reporting form published by the RMI.

A copy of Astronics’ current Form SD may be found on its website at www.astronics.com/about/conflict-minerals.

While Astronics Corporation does not currently track environmental metrics on a company-wide basis, the Company recognizes the value and importance of reducing its impact on the global environment.

SOCIAL / HUMAN CAPITAL MANAGEMENT

Human Capital Management and Corporate Culture

Astronics Corporation greatly values its employees and recognizes that, without them, the Company would not have achieved the success it has accomplished since inception. Astronics strives to provide a positive, supportive work culture with a clear global vision and a collaborative work style. The Company strongly believes that a focus on learning and supporting career development can lead to success. With low attrition and high referral rates, Astronics Corporation regularly earns “best employer” awards.

As it relates to customers, investors, suppliers and partners, the Company is dedicated to conducting business with integrity and responsibility for the greater good. Astronics Corporation promotes honest and ethical conduct, compliance with applicable government regulations and accountability by

all of its directors, officers and employees.

When considering an acquisition or partnership, the Company embeds questions specific to human capital management within its due diligence approach. These questions are in the areas of culture, equal employment opportunity, compliance with governing bodies, ethics, as well as employee benefits. Astronics Corporation asks these in an effort to ensure that the acquisition candidate is a positive cultural fit and to minimize any risk when assessing the acquisition candidate.

Relative to collective bargaining agreements, the Company has hourly production employees at PECO who are subject to collective bargaining agreements. Astronics Corporation considers its relations with all of its employees to be good.

TABLE OF CONTENTS

Astronics Corporation’s Corporate Governance Guidelines outline expectations that the Board establish and promote policies that encourage a positive, supportive work culture. The Board recognizes that culture is critical to the

long-term success of Astronics and its strategy. Therefore, the policies referenced herein apply to the Board as well as to relationships among and between the Board and employees.

The lifeblood of any organization is its employee base. Astronics relies on its individual subsidiaries to regularly gather employee feedback, using the method each subsidiary believes is most appropriate. In some instances that feedback is obtained through “Town Hall” formats; in other instances

it is obtained through surveys. However the feedback is collected, the Company expects its managers to solicit and, where applicable, use employee feedback to improve its business practices and working environment.

Astronics believes that diversity and inclusion is critical for the attraction and retention of top talent. The Company employs policies and procedures to recruit women and minority talent as well as policies to ensure pay equality. Astronics Corporation has an Equal Employment Opportunity Policy whereby the Company commits to providing equal employment opportunity

for all qualified employees and applicants without regard to race,

color, sex, sexual orientation, gender identity, religion, national origin, disability, veteran status, age, marital status, pregnancy, genetic information or other legally protected status. This policy is posted on the Astronics Corporation website at https://www.astronics.com/docs/default-source/atro-legal/careers/equal-employment-opportunity-policy.pdfcareers.

Certifications and Training

The Board of Directors has adopted a Code of Business Conduct and Ethics that is applicable to its Chief Executive Officer and Chief Financial Officer as well as all other directors, officers and employees of the Company. The Company will disclose any amendment to this Code of Business Conduct and Ethics or waiver offrom a provision of thisits Code of Business Conduct and Ethics that applies to the Company’s Chief Executive Officer, Chief Financial Officer or Principal Accounting Officer or Controller, including the name of anysuch person to whom the waiver was granted, on its website.

Further, the Company has a policy on Combatting Human Trafficking to ensure that employees, agents and suppliers of the Company do not engage in human trafficking or human trafficking activities.

The Company’s explicit statement

regarding not tolerating human trafficking can be found at https://investors.astronics.com/corporate-governance/governance-documents.corporate-governance/governance-documents.

Each subsidiary is expected to conduct both government/regulatory mandated training as well as professional development training, depending upon that subsidiary’s areas of expertise. The Company requires all of its employees to certify that they have read and understood the Code of Ethics. Based upon the needs of, and regulations associated with, each of the Company’s businesses, Astronics Corporation requires training for both regulatory and corporate compliance purposes.

Astronics is committed to the safety of its customers and its employees. Each Astronics operation maintains environmental, health and safety policies that seek to promote the operation of its businesses in a manner that is protective of the health

and safety of the public and its employees. In fact, Astronics Luminescent Systems Inc. has received safety awards from the State of New Hampshire for working more than a year without a lost time accident.

TABLE OF CONTENTS

Astronics Corporation’s operations offer several health and welfare programs to employees to promote fitness and wellness and

to encourage preventative healthcare. In addition, Astronics’ employees are offered a confidential employee

assistance program that provides professional counseling to employees and their family members. Also, many of the Company’s operations offer greenspace for employees to use during their breaks.

It is Astronics’ intention to provide a safe, healthy working environment for its employees, to the extent possible. To achieve this, the Company has created the following policies,

someall of which are available publicly, as indicated, some of which are internal to the organization:

| • | Code of Business Conduct and Ethics: https://www.astronics.com/about/corporate-responsibilitydocs/default-source/atro-legal/code-of-ethics |

| • | Statement on Human Trafficking: https://investors.astronics.com/corporate-governance/governance-documents |

| • | EEOC policy: https://www.astronics.com/docs/default-source/atro-legal/careers/equal-employment-opportunity-policy.pdfcareers |

| • | Affirmative Action Policy:https://www.astronics.com/docs/default-source/atro-legal/careers/affirmative-action-policy.pdf?sfvrsn=5908a958_2careers |

| • | Drug-free workplace statement: https://www.astronics.com/docs/default-source/atro-legal/code-of-ethics |

| • | Improper conduct/discrimination/harassment statement: https://www.astronics.com/docs/default-source/atro-legal/code-of-ethics |

| • | Health and Safety statement: https://www.astronics.com/docs/default-source/atro-legal/code-of-ethics |

| • | Whistleblower (Reporting and Effect of Violations) statement: https://www.astronics.com/docs/default-source/atro-legal/code-of-ethicsatro-legal/code- of-ethics |

Additional documents and policies may be found at: https://investors.astronics.com/corporate-governance/governance-documents.

Benefits

Astronics offers a generous benefits program for its employees. The Company provides a drug-free work environment and

requires drug screening of all candidates accepting employment.

TABLE OF CONTENTS

Astronics Corporation is proud to have received numerous awards, recognizing both product quality as well as the Company’s ability to provide an excellent work environment.

A few of these awards include: 9th Best Large Company to Work For as part of Washington’s Best 100 Places to Work for 2022 by Seattle’s Business Magazine (included in 13 of last 16 years); 2021 America by Design: People’s Choice Award; 2020 Crain’s List: Chicago’s Largest Research and Development Labs; 2019 GOOD DESIGN Award; APEX 2019 Best Cabin Innovation Award; General Atomics Supplier

Excellence Award (2016, 2017, Supplier Excellence Award; Ballard Technology 2018 Supplier Excellence Award;2018); Washington’s 100 Best Companies to Work For; Tech Briefs 2017 Product of the Year; Chicago’s

101 Best and Brightest Companies to Work For;For (2021 and 2022); Intel Supplier Continuous Quality Improvement; 2017 and 2018 Military & Aerospace Electronics Innovators Awards-Platinum; 2018 Global Technology Award; 2018, 2019 and 20202014-2022 Top Workplace Award-Orange County Register (seven(eight consecutive years) and 2021 Top Workplace Manufacturing (National).

Customer feedback is critically important to advancing initiatives and improving service levels. To accomplish this, the Company actively seeks customer feedback on an ongoing basis, relying upon each subsidiary to engage as that business

sees fit. Customer feedback mechanisms employed by Astronics subsidiaries routinely include the use of customer “scorecards” as well as soliciting input through ongoing discussions.

Astronics’ employees participate in numerous community engagement activities. Astronics supports and encourages its employees to be active and participate in local charitable activities and believes that the employee should choose to support the organization which means the most to her/him.him/them. The Company supports its employees at the subsidiary level,

subsidiary level, providing them with needed time off and, at times with matching donations, to engage with the charities of their choice. Those charities have included supporting local food banks and Marine Corps Toys for Tots. For more information, please click on each of the Company’s individual subsidiaries at https://www.astronics.com/careers.

Information security is critical to the Company’s operations around the world. We employ industry-leading security practices, while leveraging software and product security engineering to protect our networks, systems and information from cyber threats. Our cybersecurity strategy prioritizes detection, analysis and response to known, anticipated or unexpected cyber threats, effective management of cyber risks, and resilience against cyber incidents. We continuously strive to exceed industry best practices and implement risk-based controls to protect our partners’ and the Company’s information and information systems. In order to protect both commercial and defense-related businesses and support our production operations, the Company has adopted security principles in accordance with the National Institute of Standards and Technology Cybersecurity Framework, contractual requirements and other global standards. We also leverage

industry and government associations, third-party benchmarking, audits, and threat intelligence feeds, among other things, to ensure the effectiveness of our cybersecurity efforts and proactively allocate resources.

The Company’s Director of Information Technology provides a report to the Board of Directors on an annual basis, or more frequently as needed, with respect to information security activity, security assessments, controls and investments.

The Company has in place a Cyber Risk Liability Insurance policy written by the Traveler’s for a twelve-month term expiring July 1, 2023. The twelve-month premium was $63,983. The policy has a limit of $3 million in the aggregate and provides coverage related to data breaches and other cyber security measures.

GOVERNANCE

Corporate Responsibility

Astronics Corporation is dedicated to conducting business with integrity and responsibility for the greater good.responsibility. The Company promotes honest and ethical conduct, compliance with applicable government regulations and accountability by all of its directors, officers and employees. The Company’s Board has adopted Corporate Governance Guidelines and a Code of Business Conduct and Ethics which, in conjunction with Board committee charters, form the framework for its governance and is applicable to its directors and all employees. The Board regularly reviews corporate governance developments and modifies its Corporate Governance Guidelines, committee charters and key policies as warranted. The Company will disclose on its website any amendment to its Code of Business Conduct and Ethics or waiver offrom a provision of this Code of Business Conduct and Ethics that applies to the Company’s Chief Executive Officer, Chief

Financial Officer or Principal Accounting Officer or Controller, including the name of anysuch person to whom the waiver is granted. Astronics Corporation’s business is conducted by its employees, managers and officers, under the direction of the Chief Executive Officer (CEO) and the oversight of the Board, to enhance the long-term value of Astronics Corporation for its shareholders. The Board of Directors stands in a fiduciary relation to the corporationCompany and, in discharging these fiduciary duties, Directorsdirectors shall act in a manner that they reasonably believe to be in the best long-term interests of the Company, in particular, the interests of the shareholders. The Board recognizes that the interests of the Company and its shareholders are advanced when they take into account the concerns of and the effect of any action upon employees, suppliers, customers, the communities in which operations are established, and other pertinent factors.

TABLE OF CONTENTS

Governance Highlights

| | | | | Supermajority of independent directors | |

| | | | | Independent Board Committees | |

| | | | | Annual Board member election | |

| | | | | Require double-trigger for equity acceleration under employment termination benefit agreements upon a change in control | |

| | | | | Maintain a competitive compensation package | |

| | | | | Strong lead independent director role and responsibilities | |

| | | | | Require stock ownership for the Board of Directors | |

| | | | | Annual Board and Committee self-evaluations | |

| | | | | Strategy and risk oversight by full Board | |

| | | | | Board and Committees have the right to retain independent outside financial, legal or other advisors | |

| | | | | Director “overboarding” limits | |

| | | | | Regular executive sessions of independent directors | |

| | | | | CEO succession plan | |

Astronics has several policies and charters to guide the conduct and action of the Company’s employees and Board of Directors. Some of the Company’s policies contain sensitive

information and are not made public, such as our policies on Social Media and Cybersecurity. Website links for those that are available to the public follow as indicated:

| • | Audit Committee Charter:

|

https://investors.astronics.com/corporate-governance/governance-documents

Compensation Committee Charter:

https://investors.astronics.com/corporate-governance/governance-documents

Nominating/Governance Committee Charter:

https://investors.astronics.com/corporate-governance/governance-documents

Corporate Governance Guidelines:

https://investors.astronics.com/corporate-governance/governance-documents

| • | Compensation Committee Charter:

|

https://investors.astronics.com/corporate-governance/governance-documents

| • | Nominating/Governance Committee Charter:

|

https://investors.astronics.com/corporate-governance/governance-documents

| • | Sustainability Committee Chater:

|

https://investors.astronics.com/corporate-governance/governance-documents

| • | Corporate Governance Guidelines:

|

https://investors.astronics.com/corporate-governance/governance-documents

| • | Political contributions statement: https://www.astronics.com/docs/default-source/atro-legal/code-of-ethics |

Social media policy

Cybersecurity policy; compliant with NIST 800-171

TABLE OF CONTENTS

PROPOSAL 1: ELECTION OF DIRECTORS

| | | | | THE BOARD RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES.

Nominees for Director Nominated by the Board of Directors for Terms Expiring in 20222024 | |

New Board Developments since the 2022 Proxy Statement

On February 24, 2023, Ms. Linda O’Brien joined the Board of Directors of Astronics Corporation.

Mr. Raymond Boushie was not nominated for re-election

at the Annual Meeting. Mr. Boushie has served on the Board since 2005. The Company and the Board of Directors are grateful for his service.

Astronics Corporation’s By-Laws, as amended, provide that the Board of Directors shall be composed of not less than three nor more than nine persons, as determined by the Board of Directors. Currently, the Board includes nine members, elected at each annual meetingAnnual Meeting of shareholders and who serve for a term of one year or until their successors are duly elected and qualified.

Each ofDirector Raymond Boushie will not stand for re-election at the Directors attended at least 75%Annual Meeting. As a result, there would be one vacancy on the Board following the Annual Meeting. However, the Nominating/ Governance Committee has recommended to the Board, and the Board has approved, a reduction in the size of the Board meetings held in 2020. With the exception of Peter Gundermann, eachas of the nominees is independent within the meaning of the NASDAQ Stock Market, LLC director independence standards as currently in effect.Annual Meeting from nine members to eight members.

Unless instructions to the contrary are received, it is intended that the shares represented by proxies will be voted for the election as Directors of Raymond W. Boushie, Robert T. Brady, Tonit M. Calaway, Jeffry D. Frisby, Peter J. Gundermann, Warren C. Johnson, Robert S. Keane, Neil Y. Kim, and Mark Moran, and Linda G. O’Brien, each of whom has been previously elected by Astronics Corporation shareholders.shareholders other than Ms. O’Brien. Ms. O’Brien was recommended to the Nominating/Governance Committee for consideration as a director by a non-management director. If any of these nominees should become unavailable for election for any reason, it is intended that the shares represented by the proxies solicited herewith will be voted for such other person as the Board of Directors shall designate. The Board of Directors has no reason to believe that any of these nominees will be unable or unwilling to serve if elected to office. The following information is provided concerning the nominees for director:

TABLE OF CONTENTS

PROPOSAL 1: ELECTION OF DIRECTORS

Included in the information below are current directors and/or director nominees of the Company who are presently serving, or have served during the preceding five years, on boards of directors of other publicly traded companies.

Raymond W. Boushie, 81

Compensation (Co-Chair) and Audit Committees; Director since 2005

Experience

Raymond W. Boushie retired in 2005 as President and Chief Executive Officer at Crane Co.’s Aerospace & Electronics segment, a position he had held since 1999. Previously he was President of Crane’s Hydro-Aire operation. Mr. Boushie has a B.A. from Colgate University, and has completed graduate work at the University of Michigan and the Wharton School of Finance at the University of Pennsylvania. Mr. Boushie has over 40 years of Aerospace industry experience.

Skills and Qualifications

Mr. Boushie’s past experience as President and CEO of a leading aerospace and electronics business has provided him with extensive management experience within the same industry as Astronics Corporation. His more than 40 years in the aerospace industry provide the Company with institutional knowledge and context that is extremely valuable regarding long-term strategy. This also includes his experience as past Chairman of several important industry associations – General Managers Council, Manufacturers Alliance; General Aviation Manufacturers Association; and the Aerospace Industries Association. In addition, his financial qualifications and ongoing education make him a strong asset to the Audit Committee.

Robert T. Brady, 8082

Lead Independent Director; Audit (Chair) and Nominating/GovernanceSustainability Committees; Director since 1990

Experience

Robert T. Brady retired in January 2014 as the Chairman of the Board of Moog Inc., a publicly traded company that is a designer and manufacturer of high performance motion and control systems for use in aerospace, defense, industrial and medical markets. Mr. Brady was Chief Executive Officer of Moog Inc. from 1988 to December 1, 2011, Chairman of the Board from 1996 until his retirement, and a director of Moog Inc. from 1984 until January 2014. Prior to joining Moog in 1966, Mr. Brady served as an officer in the U.S. Navy. Mr. Brady received his B.S. in Mechanical Engineering from the Massachusetts Institute of Technology and his M.B.A. from Harvard Business School.

Other Public Board Memberships

Director, M&T Bank Corporation

Skills and Qualifications

Mr. Brady’s past experience as Chairman of Moog Inc. and as director of other public companies provides Astronics Corporation with valuable insight into governance trends and metrics. Similarly, Mr. Brady’s former experience as CEO of Moog Inc. has provided him with extensive management experience within the same industry as Astronics Corporation. His institutional knowledge of the aerospace and defense industry provides helpful context in creating the Company’s long-term strategy. In addition, his financial qualifications and ongoing education make him a strong asset to the Audit Committee.

TABLE OF CONTENTS

PROPOSAL 1: ELECTION OF DIRECTORS

Tonit M. Calaway, 53

Director; Compensation (Co-Chair) and Nominating/Governance Committees; Director since 2019

Experience

Tonit M. Calaway has served as Executive Vice President, Chief Administrative Officer, General Counsel and Secretary of BorgWarner Inc. since October 2020. Prior to that she served as Chief Legal Officer, Executive Vice President and Secretary of BorgWarner Inc. from August 2018. Previously, Ms. Calaway served as Executive Vice President and Chief Human Resources Officer from 2016 to August 2018. Before joining BorgWarner, Ms. Calaway held various positions during her 18-year career at Harley-Davidson, Inc., including Vice President of Human Resources and President of The Harley-Davidson Foundation. A securities attorney by training, Ms. Calaway rose through the legal department, serving as Associate General Counsel - Motor Company Operations, Assistant General Counsel, Chief Compliance Counsel, and Assistant Secretary. Ms. Calaway is a graduate of the University of Wisconsin - Milwaukee, and received her juris doctorate from the University of Chicago Law School. She is a member of the State Bar of Wisconsin.

Other Public Company Board Memberships

W.P. Carey Inc.

Skills and Qualifications

Ms. Calaway brings deep legal expertise in addition to strong management leadership experience as a member of the Executive team for a large Fortune 500 company. In addition, Ms. Calaway played a significant role in modernizing Borg Warner’s business practices and strengthening its relationships with key stakeholders, and excels at driving transformational change. She has deep experience in designing compensation programs, interfacing with collective bargaining groups, and in building consensus. Her skillsets are particularly valuable in her role as Co-Chair of the Compensation Committee and her role on the Nominating/Governance Committee.

Jeffry D. Frisby, 6567

Director; Nominating/GovernanceSustainability (Chair) and Audit Committees; Director since 2016

Experience

Jeffry D. Frisby serves as the President and Chief Executive OfficerChairman of PCX Aerostructures, LLC, primarily a supplier of flight critical mechanical systems and assemblies, including rotor heads, complex shaftslanding gear and related components.external fuel tanks. He was President and Chief Executive Officer of PCX Aerostructures, LLC from April 2017 until September 2021. Previously, Mr. Frisby was Chief Executive Officer of Triumph Group, Inc., a publicly traded company that is a global leader in manufacturing and overhauling aerospace structures, systems and components, from July 2012 until April 2015, and its President from July 2009 until April 2015. Mr. Frisby served as Triumph’s Chief Operating Officer from July 2009 to July 2012. Previously, he had been Group President of Triumph Aerospace Systems Group, a group of companies that design, engineer and manufacture a wide range of proprietary and build-to-print components, assemblies and systems for the global aerospace original equipment manufacturers, from April 2003 to July 2009. He also held a variety of other positions within the Triumph Group as well as a predecessor group company, Frisby Aerospace, Inc. Mr. Frisby served as a Director of Triumph Group, Inc. from 2012 to April 2015. Mr. Frisby holds a B.S. in Business from Wake Forest University, Calloway School of Business. Mr. Frisby has over 40 years of Aerospace industry experience.

Other Public Company Board Memberships

Director, Quaker Houghton

Skills and Qualifications

Mr. Frisby brings significant aerospace experience spanning nearly 40 years, in addition to deep executive leadership, M&A and manufacturing expertise from his service as President and CEO of PCX Aerostructures as well as Triumph Group, Inc. Other skills include accounting/finance, financial reporting, industrial marketing, organizational development, global organizations, strategic planning and corporate development. Mr. Frisby brings complementary experience in corporate governance, audit and compensation through his service on the boards of other public and private companies.

TABLE OF CONTENTS

PROPOSAL 1: ELECTION OF DIRECTORS

Peter J. Gundermann, 5860

Chairman of the Board, Director, President and Chief Executive Officer of the Company; Director since 2001

Experience

Peter J. Gundermann has been a director of Astronics since 2001 and has held the position of President and Chief Executive Officer of the Company since 2003. Mr. Gundermann was named Chairman of the Board in June 2019. Mr. Gundermann had previously served as the President of Astronics’ Aerospace and Defense subsidiaries since 1991 and has been with the Company since 1988. He holds a B.A. in Applied Mathematics and Economics from Brown University and earned an M.B.A. from Duke University.

Other Public Company Board Memberships

Director, Moog Inc.

Skills and Qualifications

Mr. Gundermann brings his deep institutional knowledge of the aerospace industry and of Astronics Corporation based on his tenure with the Company of more than thirty years. During this time, he has gained experience in the areas of M&A, finance and accounting, manufacturing and logistics, strategy, product development, customer management, and public company processes.

Warren C. Johnson, 6163

Director, CompensationNominating/Governance and Nominating/GovernanceSustainability Committees; Director since 2016

Experience

Warren C. Johnson served as President of the Aircraft Group for Moog Inc. from 2007 to 2016. Mr. Johnson was Vice President and General Manager of Moog’s Aircraft Group from 1999 to 2007 and prior to that served as Chief Engineer and Military Aircraft Product Line Manager of the Moog Aircraft Group. Mr. Johnson holds a B.S. and M.S. in Mechanical Engineering from The Ohio State University. In 2004, Mr. Johnson completed a Sloan Fellows M.B.A. at the Massachusetts Institute of Technology.

Skills and Qualifications

Mr. Johnson brings noteworthy aerospace experience from his 33-year career at Moog Inc., a worldwide manufacturer of precisionhigh performance motion and control componentssystems for use in aerospace, defense, industrial and systems,medical markets, including leading Moog'sMoog’s efforts to streamline aerospace product development cycle time and lean activities. His experience includes global operations as well as evaluating and integrating acquisition candidates.

TABLE OF CONTENTS

PROPOSAL 1: ELECTION OF DIRECTORS

Robert S. Keane, 5860

Director, Compensation and AuditNominating/Governance Committees; Director since 2019

Experience

Robert S. Keane has served as President and Chief Executive Officer of Cimpress plc since he founded Cimpress in January 1995 and as Chairman of Cimpress plc’s Board of Directors since November 2018. Mr. Keane previously served as Chairman of Cimpress’s former Management Board from September 2009 to November 2018 and as the Chairman of its Board of Directors from January 1995 to August 2009. From 1988 to 1994, Mr. Keane was an executive at Flex-Key Corporation, a former subsidiary of Astronics Corporation. Mr. Keane earned his B.A. in Economics from Harvard College and his MBA from INSEAD (France).

Other Public Company Board Memberships

Chairman, Cimpress plc

Skills and Qualifications

Mr. Keane has extensive experience leading complex, global operations. He has a strong track record of growing successful companies both organically and by acquisition and is very experienced with public company processes. His previous experience with Astronics early in his career gives him a unique insight into the history and culture of the company.Company.

Neil Y. Kim, 6264

Director, Compensation (Chair) and Audit Committees; Director since 2016

Experience

Neil Kim served as Chief Technology Officer and Executive Vice President of Marvell Technology Group Ltd. from April 2017 until his retirement in May 2019. Prior to that, Mr. Kim served as Broadcom Corporation’s Executive Vice President of Operations and Central Engineering until 2016 and was responsible for the company’s global manufacturing including foundry operations, supply chain management and corporate procurement. Mr. Kim joined Broadcom in 2000 and held a variety of senior management positions including Senior Vice President and Vice President of Central Engineering, as well as Senior Vice President of Operations and Engineering. Prior to Broadcom, from 1993 to 2000, Mr. Kim held a variety of senior technical and management positions at Western Digital Corporation, a provider of products and services for storage devices. His roles included Vice President of Engineering, where he managed critical product development and technical transitions. Mr. Kim served on the board of the Global Semiconductor Association from 2009 to 2015. Mr. Kim is named as an inventor on 33 patents. He received a B.S. in Electrical Engineering from the University of California, Berkeley.

Other Public Company Board Memberships

Silicon Laboratories Inc.(1)

(1) Mr. Kim’s term as director of Silicon Laboratories Inc. expired in April 2017.

Skills and Qualifications

Mr. Kim brings deep expertise in global operations, supply chain and manufacturing, as well as executive leadership. In addition to his public and private company Board experience, Mr. Kim has significant experience working for and with global organizations and in identifying, executing and integrating acquisitions.

TABLE OF CONTENTS

PROPOSAL 1: ELECTION OF DIRECTORS

Mark Moran, 6567

Director, CompensationNominating/Governance (Chair) and Nominating/GovernanceCompensation Committees; Director since 2018

Experience

Mark Moran served as the Chief Operations Officer of Continental Airlines prior to his retirement in 2012. He spent 17 years with Continental prior to its acquisition by United Airlines. During his tenure, which included eight years as the head of Operations, Continental grew to the fifth largest U.S.US airline with 2,600 daily flights to over 260 airports. Since his retirement from Continental, Mr. Moran has served as an independent aviation consultant to several multinational OEMs and Tier 1 suppliers to OEMs. Prior to Continental, Mr. Moran served ten years with USAir/Piedmont, and before that, five years with Boeing Corporation. He is a graduate of Marquette University, where he earned a B.S. in Engineering.

Skills and Qualifications Mr. Moran brings strong aerospace experience to the Astronics board due to his career in the commercial airline industry. His perspective as a customer is a unique contribution to our deliberations. The Company is increasingly involved with promoting its products directly to operators, and his in-depth knowledge of airline operations and priorities complements the perspectives of others in the group.

Linda O’Brien, 59

Director; Director since 2023

Experience

Linda G. O’Brien has served as Vice President and Chief Engineer-Aeronautics of Lockheed Martin Aeronautics since September 2021. She was originally employed by Lockheed/General Dynamics from 1986 to 2006, rejoining Lockheed Martin Aeronautics in 2016. At Lockheed, Ms. O’Brien held a variety of positions before assuming her current role, including Program Management Director and Deputy Vice President of ISR and Unmanned Systems (June 2019-September 2021), Engineering Director-Deputy to the Vice President of Engineering and Technology (February 2018-May 2019) and Engineering Director-Chief Engineer of Advanced Pilot Training (April 2016 to February 2018). Prior to Lockheed, Ms. O’Brien was a Senior Program Manager at Sikorsky Aircraft Company and Director of Commercial Programs for Bell Helicopter Textron. Ms. O’Brien holds a B.S. in Mechanical Engineering from the University of Tennessee, a M.S. in Mechanical Engineering from Southern Methodist University and an M.B.A. from Texas Christian University.

Skills and Qualifications

Ms. O’Brien brings over 35 years of strong technical and aerospace industry experience to the Astronics board. Her perspective as an engineer is a unique contribution to our deliberations and complements the perspectives of others in the group.

TABLE OF CONTENTS

BOARD MATTERS

Board of Directors Independence

APursuant to the Nasdaq listing standards, a majority of the Directors shallare required to be independent, as that term is defined by applicable laws and regulations and in the NASDAQNasdaq listing standards. A Director will be considered independent only if the Board has affirmatively determined that the Director has no material relationship with Astronics, either directly or as a partner, shareholder or officer of an organization that has a relationship with Astronics that, based on the requirements of applicable laws and regulations and the NASDAQNasdaq listing standard, would impair his or her independent judgment. NotUnder the terms of the Company’s corporate governance guidelines, not more than three individuals who fail to be determined to be independent Directors shall serve on the Board at any one time, provided, however, that this limitation on the number of non-independent directors shall not require a Director to resign or retire from the Board prior to the expiration of a term to which he or she was duly elected by the shareholders so long as the Board then has a majority of independent Directors.

The Board will annually review all commercial and charitable relationships of Directors to determine if there is a material

relationship that would preclude the Board from making an affirmative determination that an individual Director is independent. To facilitate this review, each non-employee Director will annually provide information regarding the Director’s business and other relationships with Astronics, its affiliates and senior management to enable the Board to evaluate the Director’s independence. This determination will be disclosed in the proxy statement for Astronics Corporation’s annual meeting of shareholders.

The Board of Directors has determined that each of its current directors, except for Mr. Gundermann, is independent within the meaning of the NASDAQNasdaq Stock Market, LLC director independence standards as currently in effect. In addition, each member of the Audit Committee, the Compensation Committee, the Nominating/Governance Committee and the Nominating/GovernanceSustainability Committee is independent.

Board of Directors Ethics and Commitment

Directors shall possess the highest personal and professional ethics and integrity, and, in performance of their duties as directors, shall represent the long-term interests of the shareholders. The Board believes that its membership should reflect a diversity of experience, gender, race and ethnicity. Directors are selected on the basis of experience and personal capacities, including experience in industries similar to Astronics Corporation’s, managerial or other leadership experience; business acumen or particular expertise, business development experience, strategic capability, independence of judgment; familiarity with corporate governance, risk assessment and the responsibilities of directors; standing and reputation as a person of integrity; the potential contribution of each individual to the diversity of backgrounds, experience

and competencies which the Nominating/Governance Committee desires to have represented and ability to work constructively with the CEO and the Board.

Directors must devote sufficient time to carrying out their duties and responsibilities effectively and should be committed to serving on the Board for an extended period of time. Directors are expected to inform the Chairman if there is any significant change in their personal circumstances, including a change in their principal job responsibilities. Directors are expected to attend meetings of the Board and Committees of the Board on which they serve, except for good reason, and be prepared.

Board of Directors Meetings and Standing Committees

The Board of Directors and its committees meet regularly throughout the year and also hold special meetings and act by written consent from time to time as appropriate. All directors are expected to attend each meeting of the Board of Directors

and the committees on which s/he serves, and are also invited, but not required, to attend the Annual Meeting. During the year ended December 31, 2022, the Board of Directors held

eight meetings. Each director attended at least 75% of the total number of meetings of the Board of Directors and the committees on which she/he/they serves held in 2022, other than Mr. Gundermann attended the 2020 Annual Meeting, butBoushie and Mr. Keane. Mr. Boushie was unable to attend at least 75% of such meetings due to travel restrictions related to the COVID-19 pandemic, Ms. Calawayhealth issues.

TABLE OF CONTENTS

andMr. Gundermann attended the 2022 Annual Meeting, but due to the continuing COVID-19 pandemic, Messrs. Boushie, Brady, Frisby, Johnson, Keane, Kim and Moran were unable todid not attend.

The Board of Directors has threefour standing committees: an Audit Committee,Committee; a Compensation Committee,Committee; a Nominating/Governance Committee; and a Nominating/GovernanceSustainability Committee. During the

year ended December 31, 2020, the Board of Directors held six meetings. Each director attended at least 75% of the meetings of the Board of Directors heldThe Sustainability Committee was established in 2020.February 2022.

The Audit Committee consists of Messrs. Brady (Chair), Boushie, Frisby Keane and Kim, each of whom is independent within the meaning of the NASDAQNasdaq Stock Market, LLC director independence standards as currently in effect. The Board of Directors has determined that it has more than oneeach of Messrs. Brady, Boushie and Frisby qualify as an “audit committee financial expert” as defined under federal securities laws serving on its Audit Committee. Information regarding the functions performed by the Committee is set forth in the “Report of the Audit Committee” included in this proxy statement.

The Audit Committee held four meetings in 2020. Each member of the Audit Committee attended at least 75% of the meetings of the Audit Committee held in 2020. 2022.

The Audit Committee is governed by a written charter approved by the Board of Directors that is posted on the “Corporate Governance” section of the Company’s website at https://investors.astronics.com/corporate-governance.

Effective as of the date of the Annual Meeting, the Audit Committee will consist of Messrs. Brady (Chair), Frisby and Kim.

The Compensation Committee consists of Mr.Messrs. Kim (Chair), Boushie, (Co-Chair), Ms. Calaway (Co-Chair), Messrs. Johnson, Keane Kim and Moran, each of whom is independent within the meaning of the NASDAQNasdaq Stock Market, LLC director independence standards as currently in effect. The Compensation Committee is responsible for reviewing and approving compensation levels for the Company’s executive officers and reviewing and making recommendations to the Board of Directors with respect to other matters relating to the compensation practices of the Company. In appropriate circumstances, the Compensation Committee considers the recommendations of the Company’s Chief Executive Officer with respect to reviewing and approving compensation levels

for other executive officers. The Compensation Committee does not use outside compensation

consultants on a regular basis. The Committee may consult broad-based, third-party survey data to obtain a general understanding of current compensation practices of companies of similar size and industry in which the Company competes for employees.

The Compensation Committee held three meetings in 2020. Each of the Compensation Committee members attended at least 75% of the meetings of the Compensation Committee held in 2020. 2022.

The Compensation Committee is governed by a written charter approved by the Board of Directors that is posted on the “Corporate Governance” section of the Company’s website at https://investors.astronics.com/corporate-governance.

Effective as of the date of the Annual Meeting, the Compensation Committee will consist of Messrs. Kim (Chair), Keane and Moran, and Ms. O’Brien.

Nominating/Governance Committee

The Nominating/Governance Committee consists of Mr. FrisbyMoran (Chair), Ms. Calaway, and Messrs. Brady, Johnson and Moran,Keane, each of whom is independent within the meaning of the NASDAQNasdaq Stock Market, LLC director independence standards as currently in effect. The Nominating/Governance Committee is responsible for evaluating and selecting candidates for the Board of Directors and addressing and overseeing corporate governance matters on behalf of the Board of Directors.

In performing its duties to recommend nominees for the Board of Directors, the Nominating/Governance Committee seeks director candidates with the following qualifications, at minimum: high character and integrity; substantial life or work experience that is of particular relevance to the Company; sufficient time available to devote to his or her duties; and ability and willingness to represent the interests of all shareholders rather than any special interest group. The Nominating/Governance Committee may use third-party search

firms to identify Board of Director candidates. It also relies

upon recommendations from a wide variety of its contacts, including current executive officers, directors, community leaders and shareholders, as a source for potential candidates.

Shareholders wishing to submit or nominate candidates for election to the Board of Directors must supply information in writing regarding the candidate to the Nominating/Governance Committee at the Company’s executive offices in East Aurora, New York. This information should include the candidate’s name, biographical data and qualifications. Generally, the Nominating/Governance Committee will conduct a process of making a preliminary assessment of each proposed nominee based upon biographical data and qualifications. This information is evaluated against the criteria described above and the specific needs of the Company at the time. Additional information regarding proposed nominees may be requested. On the basis of the information

gathered in this process, the Nominating/Governance Committee determines which nominees to recommend to the

TABLE OF CONTENTS

Board of Directors. The Nominating/Governance Committee uses the same process for evaluating all nominees, regardless of the source of the recommendation.

The Nominating/Governance Committee held twofour meetings in 2020. Each of the members of the Nominating/Governance

Committee attended at least 75% of the meetings held in 2020.2022. The Nominating/Governance Committee is governed

by a written charter that is posted on the “Corporate Governance” section of the Company’s website at https://investors.astronics.com/corporate-governance.

Effective as of the date of the Annual Meeting, the Nominating/Governance Committee will consist of Messrs. Moran (Chair), Johnson and Keane and Ms. O’Brien.

In February 2022, the Board of Directors established a Sustainability Committee. The Sustainability Committee consists of Messrs. Frisby (Chair), Brady and Johnson. The Sustainability Committee held one meeting in 2022.

The Sustainability Committee is governed by a charter that was adopted on September 8, 2022. The Sustainability

Committee assists the Board in its assessment and evaluation of the Company’s sustainability programs and initiatives pertaining to the Company’s business, operations and employees. The charter is posted on the “Corporate Governance” section of the Company’s website at https://investors.astronics.com/corporate-governance.

Executive Sessions of the Board

Non-managementIndependent directors meet regularly in executive sessions. Non-management directors are all those directors who are not Company employees and includes directors, if any, who are not independent as determined by the Board of Directors. The Company’s non-management directors consist of all of its current directors except Mr. Gundermann. An executive

An executive session of the Company’s non-management directors is generally held in conjunction with each regularly scheduled Board of Directors meeting. Additional executive sessions may be called at the request of the Board of Directors, the Lead Independent Director or the non-management directors.

Role of the Lead Independent Director

In addition to the Chairman, the Board has a Lead Independent Director. Mr. Brady has served in this role since February 2020. The principal role of the Lead Independent Director is to serve as liaison between the Chairman and CEO and the Directors. The specific responsibilities of the Lead Independent Director are, among others, to:

(i) collaborate with the Chairman and CEO to ensure the appropriate flow of information to the Board;

(ii) consult with the Chairman and CEO regarding Board agenda items;

(iii) coordinate and develop the agenda for and preside at executive sessions and sessions of the Board’s independent Directors, and as appropriate, communicate to the Chairman and CEO the substance of the discussions;

(iv) in the absence of the Chairman, act as Chair of meetings of the Board;

(v) recommend, when necessary, special meetings of the Board; and

(vi) act as principal liaison between the Directors and the Chairman and CEO on sensitive issues.

The agenda for each Board meeting shall be established by the Chairman and the Lead Independent Director, and any Director may request items to be included on the agenda. Ample time is scheduled for each Board meeting to assure full discussion of important matters whether included on the agenda or not. Agendas always include financial and operating reports in addition to other reports, such as business unit and subject matter presentations, that could enhance a Director’s perspective and knowledge on various matters. Agenda and meeting materials are distributed in advance of Board and Committee meetings, and each Director has a duty to review the materials prior to the meeting.

Board Refreshment and Experience

The Board is committed to continuous improvement and employs a rigorous process to ensure that the composition of the Board is diverse, balanced and aligned with the evolving needs of the Company. The Board assesses the diversity of the directors’ experience, expertise, perspective, tenure and age, among other attributes, to ensure it has an appropriate mix of skills and experience to fulfill its oversight obligations.

The Board also considers the Company’s long-term strategy when evaluating which specific skills and experience are

required and weighs those skills when evaluating the current and potential directors. As part of the evaluation of the directors’ skills and experience, the Board reviews a director skillset chart which identifies expertise, experience and other characteristics that contribute to an effective and

well-functioningwell- functioning board. The skills and qualifications for each current Director may be found

within their biographies on pages

1214 to

1617.

TABLE OF CONTENTS

Annual Board Evaluation Process

The Board and each of the Committees shall performcommittees performs annual self-evaluations. The Nominating/Governance Committee will developdevelops and conductconducts the Board evaluation and will ensureensures that

that each Committeecommittee of the Board conducts its own self-evaluation. The Board of Directors then reviews this feedback and makes improvements, as necessary.

Limit on Other Directorships

Directors who also serve as CEOs or in equivalent positions should not serve on more than two boards of public companies in addition to the Astronics Board, and other Directors should not serve on more than four other boards of public companies in addition to the Astronics Board. Membership on moreadditional public company boards beyond the limits specified above by a director for exceptional reasons requires approval by the Nominating/Governance Committee or its chairperson. Directors are expected to notify the Nominating/Governance

Committee in writing before accepting

election or appointment to any public company board on which they did not serve when appointed to the Astronics Board.

The Board does not believe that arbitrary term limits on Directors’ service are appropriate nor does it believe that Directors should expect to be renominated annually. The Board self-evaluation process noted below will bedescribed above is an important determinant for Board tenure.

Board Interaction with Shareholders

Although the Company does not have a formal policy regarding communications with the Board of Directors, shareholders may communicate with the Board of Directors by writing to: Board of Directors, Astronics Corporation, 130 Commerce Way, East Aurora, New York 14052. Shareholders who would like their submission directed to a

particular director may so specify and the communication will be forwarded, as appropriate.

The Board believes that management should speak for the corporation.Company. Accordingly, each Director willmay refer all inquiries from shareholders, analysts, the press or customers to the CEO.

Proxy Access

Shareholder Director Nominations

A shareholder entitled to vote in the election of Directors, may nominate a candidate for the Board of Directors only if written notice of the shareholder’s intent to do so has been given, either by personal delivery or by United States mail, postage prepaid, to the Secretary of the corporationCompany and received by the corporationCompany (a) with respect to an election to be held at an annual meetingAnnual Meeting of shareholders, not later than

sixty (60) nor more than ninety (90) days prior to the first anniversary of the preceding year’s annual meetingAnnual Meeting (or, if the date of the annual meetingAnnual Meeting is changed by more than twenty (20) days from such anniversary date, within ten (10) days after the date the corporationCompany mails or otherwise give notice of the date of such meeting)Annual Meeting), and (b) with respect to an election to be held at a special meeting of

shareholders called for that purpose, not later than the close of business on the tenth (10th) day following the date on which notice of the special meeting was first mailed to the shareholders of the corporation.Company.

Each shareholder’s notice of intent to make a nomination shall set forth: (i) the name(s) and address(es) of the shareholder who intends to make the nomination and of the person or persons to be nominated; (ii) a representation that the shareholder (a) is a holder of record of stock of the corporationCompany entitled to vote at such meeting,Annual Meeting, (b) will continue to hold such stock through the date on which the meetingAnnual Meeting is held, and (c) intends to appear in person or by proxy at the meetingAnnual Meeting to nominate the person or persons specified in the notice; (iii) a description of all arrangements or understandings between the shareholder and each nominee and any other person or persons (naming such

person or persons) pursuant to which the nomination is to be made by the shareholder; (iv) such other information regarding each nominee proposed by such shareholder as would be required to be included in a proxy statement filed pursuant to Regulation 14A promulgated under Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as now in effect or hereafter modified, had the nominee been nominated by the Board of Directors; and (v) consent of each nominee to serve as a director of the

TABLE OF CONTENTS

corporation Company if so elected. The corporationCompany may require any proposed nominee to furnish such other information as may reasonably be required by the corporationCompany to determine the qualifications of such person to serve as a director.

No person shall be eligible for election as a director unless nominated (i) by a shareholder in accordance with the foregoing procedure or (ii) by the Board of Directors or a committee designated by the Board of Directors.

Board Evaluation and Oversight of Risk

The Board of Directors oversees an enterprise-wide approach to risk management, designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance shareholder value. A fundamental part of risk management is to understand the specific risks the Company faces and what mitigating steps are being taken, while balancing what is an appropriate level of risk for the Company. The involvement of the full Board of Directors in setting and overseeing business strategy is a key part of its assessment of management’s appetite for risk and also a determination of what constitutes an appropriate level of risk for the Company. On a regular basis, senior leaders are invited to present to the Board of Directors on each business. These presentations include opportunities as well as risks and mitigating actions. On an ongoing basis, the Company relies on its business leaders to identify and mitigate risks wherever possible.

While the Board of Directors has the ultimate oversight responsibility for the risk management process, various

committees of the Board also have oversight responsibility for specific areas of risk management. In particular, the Audit Committee focuses on financial risk, including internal controls over financial reporting, as well as compliance risk. In addition, in setting compensation, the Compensation Committee strives to create incentives that encourage a level of risk-taking behavior consistent with the Company’s business strategy. The Sustainability Committee oversees the Company’s sustainability programs and assists in the integration of sustainability planning into the Company’s risk management process. The Company maintains a Cybersecurity policy as well as Complaintcomplaint procedures for accounting and auditing matters, (“Whistleblower”), the latter of which may be found on the Corporate Governance section of the Company’s website. The Company conducts regular periodic training of its employees as to the protection of sensitive information which includes security awareness training intended to prevent the success of “phishing” attacks.

Board Leadership Structure and Size

At present, the Board has determined that combining the roles of the Chief Executive Officer and Chairman is in the best interests of the corporation.Company. In addition to the Chairman, the Board has a Lead Director.Independent Director who has substantial and significant responsibility on Board matters. The Board should beis free to reconsider that determinationthe combination of Chief Executive Officer and Chairman roles in the future.future and may decide to do so if conditions change. It is the sense of the Board that a size of 7 to 9 members is about right for the corporationCompany in light of its size and complexity of its business. The Board proposes a

slate of nominees to the shareholders for election to the Board. Shareholders may also propose nominees

for consideration by the Nominating/Governance Committee by submitting the names and supporting information according to the deadlines set forth in the corporation’sCompany’s proxy statement for its most recent annual meetingAnnual Meeting to: Secretary, Astronics Corporation, 130 Commerce Way, East Aurora, New York 14052. Between annual shareholder meetings, the Board may elect Directors to fill vacancies to serve until the next annual meeting.Annual Meeting.

TheAmong its duties, the Board shall planplans for the succession of the CEO. To assist the Board, the CEO will presentprovides an annual succession planning summary to the Board and will adviseadvises the Board of his recommendations and evaluations of potential successors. The Compensation Committee will assureprovides assessment and feedback by the Board of Directors to the CEO on the strategic leadership, development, and internal and external representation of the Company.

The Board believes that the primary and most constructive interaction with management is through the normal process of scheduled Board and Committee meetings, whether they be on regular business or special matters, at which any discussions can

best be informed by the collective and varied knowledge and experience of Directors and management. The Board also recognizes, however, that matters of integrity and corporate conduct, were they to arise, may call for direct access to senior management. As is judicious under these circumstances, independent Directors are free to contact executive officers and other senior managers of the corporationCompany without senior corporate management present. As noted above in the Board Evaluation and Oversight of Risk discussion, senior leaders are invited on a regular basis to present to the Board of Directors on each business. In this manner, the Board becomes familiar with leadership beyond the office of the CEO and CFO.

TABLE OF CONTENTS

Directors’ and Officers’ Indemnification Insurance

The Company has in place Directors’ and Officers’ Liability Insurance policies written by the Chubb Group, Zurich, Travelers, C.N.A., AIG, AXA XL CAN, AWAC, Travelers and XL CatlinAce American Insurance Company, for a twelve-month term expiring July 1, 2021.2023. The twelve-month premium was $729,236.$828,464. The policies have limits of $55 million in the aggregate and provide indemnification benefits and the payment of expenses in actions instituted against any director or officer of the Company for claimed liability arising out of their conduct in such capacities.

The Company also has entered into indemnification agreements with its directors and certain of its officers. The indemnification agreements provide that the director or officer will be indemnified for expenses, investigative costs and judgments arising from certain threatened, pending or completed legal proceedings.

Board Composition and Diversity

The Nominating/Governance Committee is responsible for developing the general criteria, subject to approval of the Board of Directors, for use in identifying, evaluating and selecting qualified candidates for election or re-election to the Board. The Nominating/Governance Committee periodically reviews the appropriate skills and characteristics required of the Board members in the context of the current composition of the Board. The Nominating/Governance Committee, in recommending candidates to the Board, seeks to create a Board that is strong in its collective knowledge and has a diversity of skills and experience with respect to accounting and finance, management and leadership, vision and strategy, business operations, business judgment, industry knowledge, corporate governance and global markets. When the Nominating/Governance Committee reviews a potential new candidate, it looks specifically at the candidate’s qualifications in light of the needs of the Board and the Company at that time, given the attributes of the existing Directors. In identifying candidates for director, the Board of Directors takes into account:

(i)

| the comments and recommendations of board members regarding the qualifications and effectiveness of the existing Board of Directors or additional qualifications that may be required when selecting new board members, |

members regarding the qualifications and effectiveness of the existing Board of Directors or additional qualifications that may be required when selecting new board members;

(ii)

| the requisite expertise and sufficiently diverse backgrounds of the Board of Directors’ overall membership composition,composition; |

(iii)

| the independence of outside directors and other possible conflicts of interest of existing and potential members of the Board of Directors,Directors; and |

(iv)

| all other factors it considers appropriate. |

The Board of Directors believes that ethnic and gender diversity are important considerations when evaluating Director candidates along with such factors as background, skills, experience and expertise. At present, 11% of the BoardMs. O’Brien is diverse with respect to gender and 22% of the Board is diverse with respect to race/ethnicity. Ms. Calaway is diverse with respect to gender and race/ethnicity and Mr. Kim is diverse with respect to race/ethnicity. The Company will continue to consider all of these factors when proposing future candidates for the Board.

With respect to the current slate of Directors, the Board of Directors focused primarily on the information discussed in each of the directors’ individual biographies set forth elsewhere in this proxy statement. In particular, with regard to Ms. O’Brien and Messrs. Boushie, Brady, Frisby, Johnson and Moran, the Board of Directors considered their significant experience, expertise and background with regard to the aerospace

industry. With regard to Messrs. Kim and Keane, the Board of Directors considered their technical knowledge, significant mergers and acquisition experience, and expertise with complex, multinational organizations. With respect to Ms. Calaway, the Board of Directors considered her strong governance and human capital management experience. The Board of Directors also considered the more than thirty years of experience with the Company represented by Mr. Gundermann, the Company’s Chairman of the Board and Chief Executive Officer.

TABLE OF CONTENTS

BOARD MATTERS

| | Total Number of Directors | | | 9 | |

| | | | | Female | | | Male | | | Non-Binary | | | Did Not Disclose

Gender | |

| | Part I: Gender Identity | | | | | | | | | | | | | |

| | Directors | | | 1 | | | 8 | | | — | | | — | |

| | Part II: Demographic Background | | | | | | | | | | | | | |

| | African American or Black | | | — | | | — | | | — | | | — | |

| | Alaskan Native or Native American | | | — | | | — | | | — | | | — | |

| | Asian | | | — | | | 1 | | | — | | | — | |

| | Hispanic or Latinx | | | — | | | — | | | — | | | — | |

| | Native Hawaiian or Pacific Islander | | | — | | | — | | | — | | | — | |

| | White | | | 1 | | | 6 | | | — | | | — | |

| | Two or More Races or Ethnicities | | | — | | | 1(1) | | | — | | | — | |

| | LGBTQ+ | | | — | |

| | Did Not Disclose Demographic Background | | | — | |

(1)

| One director self-identifies as White and Hispanic. |

COMPENSATION OF DIRECTORS

The following table sets forth the cash compensation as well as certain other compensation of the Company’s directors for the year ended December 31, 2020:2022:

| | Name | | Fees Earned or Paid

in Cash | | Restricted

Stock Unit

Awards(4) | | Total | | Name | | Fees Earned or

Paid

in Cash | | Restricted

Stock Unit

Awards(6) | | Total | |

| | Raymond W. Boushie(1) | | $75,000 | | $110,264 | | $185,264 | | Raymond W. Boushie(1)(2) | | $75,000 | | $109,999 | | $184,999 | |

| | Robert T. Brady(1) | | $75,000 | | $110,264 | | $185,264 | | Robert T. Brady(1) | | $75,000 | | $109,999 | | $184,999 | |

| | Tonit M. Calaway(1) | | $75,000 | | $110,264 | | $185,264 | | Tonit M. Calaway(3) | | $29,670 | | $45,833 | | $75,503 | |

| | Jeffry D. Frisby(1) | | $75,000 | | $110,264 | | $185,264 | | Jeffry D. Frisby(1) | | $75,000 | | $109,999 | | $184,999 | |

| | Peter J. Gundermann(2) | | — | | — | | — | | Peter J. Gundermann(4) | | — | | — | | — | |

| | Warren C. Johnson(1) | | $75,000 | | $110,264 | | $185,264 | | Warren C. Johnson(1) | | $75,000 | | $109,999 | | $184,999 | |

| | Robert S. Keane(1)(3) | | $75,000 | | $110,264 | | $185,264 | | Robert S. Keane(1) | | $75,000 | | $109,999 | | $184,999 | |

| | Neil Kim(1) | | $75,000 | | $110,264 | | $185,264 | | Neil Kim(1) | | $75,000 | | $109,999 | | $184,999 | |

| | Mark Moran(1) | | $75,000 | | $110,264 | | $185,264 | | Mark Moran(1) | | $75,000 | | $109,999 | | $184,999 | |

| | | Linda O’Brien(5) | | — | | — | | — | |

(1)

| In 2020, Ms. Calaway and2022, each of Messrs. Boushie, Brady, Frisby, Johnson, Keane, Kim and Moran were awarded 5,6008,112 Restricted Stock Units under the Amended and Restated 2017 Long Term Incentive Plan. Each Restricted Stock Unit represents the right to receive, at settlement, one share of Common Stock. The Restricted Stock Units issued to Messrs. Boushie, Brady, Frisby, Johnson, Keane, Kim and Moran vested in full six months from the grant date on August 24, 2022, on which date each of Messrs. Boushie, Brady, Frisby, Johnson, Keane, Kim and Moran were issued 8,112 shares of Common Stock. At December 31, 2022, Messrs. Boushie, Brady, Frisby, Johnson and Kim had options to purchase 20,000; 20,000; 8,000; 8,000 and 8,000 shares of Common Stock, respectively, and 9,273; 9,273; 1,200; 1,200 and 1,200 shares of Class B Stock, respectively. The exercise price is 100% of the fair market value on date of grant. As of December 31, 2022, Mr. Keane and Mr. Moran did not have any options to purchase shares of Common Stock or Class B Stock. |

(2)

| Mr. Boushie’s term as director will expire on the date of the Annual Meeting. |

(3)

| Ms. Calaway did not stand for reelection at the Annual Meeting in 2022. In 2022, Ms. Calaway was awarded 3,380 Restricted Stock Units under the Amended and Restated 2017 Long Term Incentive Plan. Each Restricted Stock Unit represents the right to receive, at settlement, one share of Common Stock. The Restricted Stock Units issued to Ms. Calaway and Messrs. Boushie, Brady, Frisby, Johnson, Keane, Kim and Moran vested in full six monthsupon her exit from the grant dateBoard in May 23, 2022, and on August 28, 2020, on which dateMay 31, 2022, Ms. Calaway and each of Messrs. Boushie, Brady, Frisby, Johnson, Keane, Kim and Moran werewas issued 5,6003,380 shares of Common Stock. AtAs of December 31, 2020, Messrs. Boushie, Brady, Frisby, Johnson and Kim had2022, Ms. Calaway did not have any options to purchase 25,500; 25,500; 8,000; 8,000 and 8,000 shares of Common Stock respectively, and 18,255; 18,255; 1,200; 1,200 and 1,200 shares ofor Class B Stock, respectively. The exercise price is 100%Stock. |

(4)

| Mr. Gundermann receives no separate compensation as a director of the fair market value on date of grant. As ofCompany. |

(5)

| Ms. O’Brien joined the Board in February 2023 and did not receive any compensation in 2022. At December 31, 2020,2022, Ms. Calaway, Mr. Keane and Mr. MoranO’Brien did not have any options to purchase shares of Common Stock or Class B Stock. |

(2)

| Mr. Gundermann receives no separate compensation as a director of the Company. |

(3)

| At December 31, 2020, the Estate of Kevin T. Keane, the father of Mr. Robert Keane, had options to purchase 4,000 shares of Common Stock and 600 shares of Class B Stock. Mr. Robert Keane is one of multiple beneficiaries to a trust to be established by the estate. Mr. Robert Keane’s proportionate interest in the estate is below 25%. The options expire on June 10, 2021. |

(4)

(6)

| The total fair value of the award is determined under generally accepted accounting principles used to calculate the value of equity awards for purposes of the Company’s financial statements as described in Note 16 to the audited financial statements in Astronics Corporation’s Annual Report on Form 10-K for the year ended December 31, 2020.2022. The amounts do not reflect the actual amounts realized by the director. |

Compensation Committee Interlocks and Insider Participation

No interlocking relationship exists between any member of the Compensation Committee or any of the Company’s executive officers and any member of any other company’s board of directors or compensation committee (or equivalent).

No member of the Compensation Committee was, during 20202022 or prior thereto, an officer or employee of the Company

or any of its subsidiaries.subsidiaries, except that from 1988 to 1994, Mr. Keane was an executive at Flex-Key Corporation, a former subsidiary of Astronics Corporation.

Board of Directors Stock Ownership Requirement

The Board believes that, in order to align the interests of the Directors and shareholders, Directors should have a significant financial stake in the corporation.Company. The Corporate Governance Guidelines adopted by the Board in December 2019, as amended on February 26, 2021, provide that within four years of joining the Board or within four years of adoption of the

Guidelines, whichever is later, each non-employee Director is

expected to accumulate and maintain ownership of at least the number of shares equal to 400% of the annual cash retainer for the applicable calendar year, divided by the average of the closing price of a share of Astronics Corporation Common Stock for the previous calendar year.

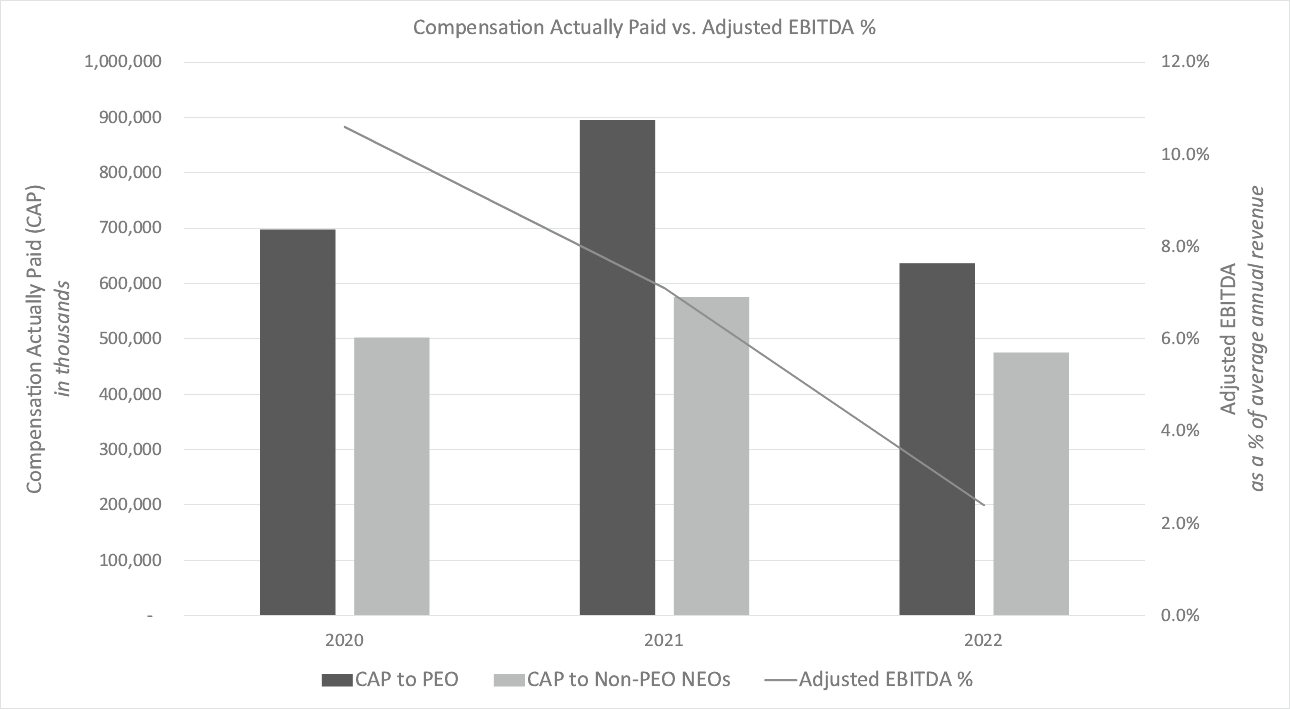

TABLE OF CONTENTS